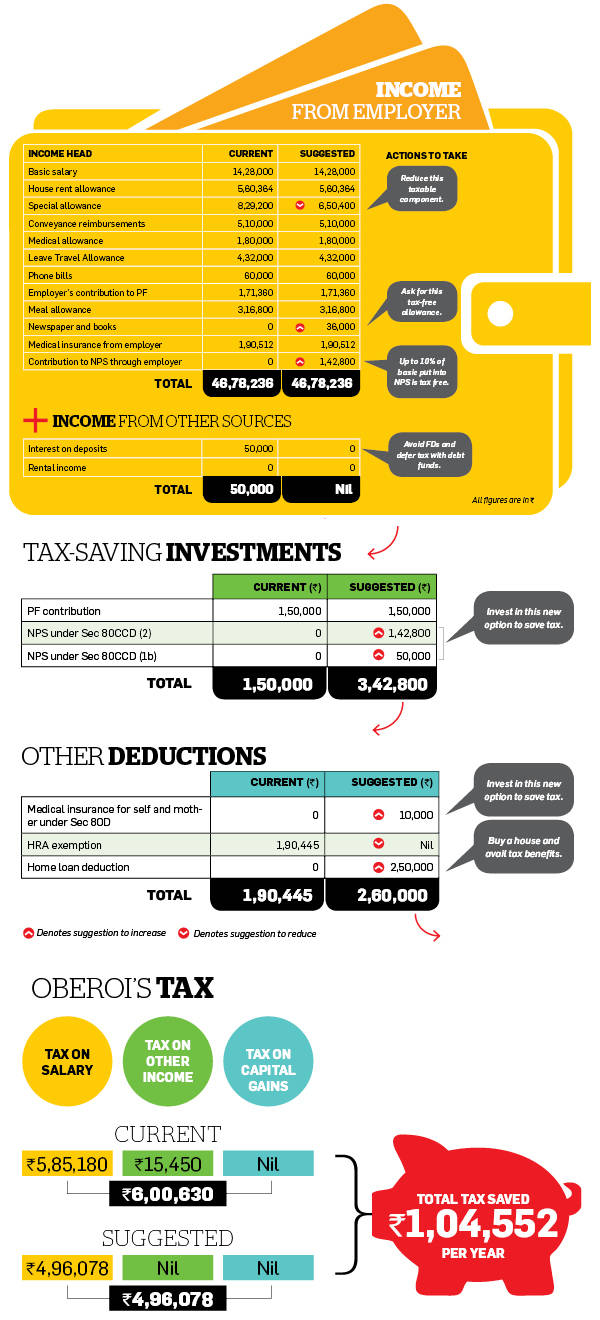

Rishi Oberoi, 40, has an annual pay package of over Rs 46 lakh but almost 13% of this goes into tax. Though his salary is quite tax-friendly,Taxspanner estimates that he can bring down his tax by over Rs 1 lakh by slightly tweaking his pay package, investing more for tax savings and taking a home loan.

Oberoi's company does not allow rejigging of the pay structure. If they put 10% of his basic into the NPS, his tax can come down by Rs 44,000. If he gets certain tax-free perks such as reimbursements for newspapers and periodicals, he can reduce his tax by another Rs 11,000.

He should also invest Rs 50,000 in the NPS to claim deduction under Section 80CCD(1b). It will cut his tax by another Rs 15,450. However, the investments in the NPS will be locked till he is 60. Oberoi gets a high house rent allowance but most of it gets taxed. He plans to take a loan to buy a house. If he claims Rs 2 lakh as deduction for the home loan interest, his tax will be cut by around Rs 15,000 (not a big cut because the HRA will be taxable). If he buys health insurance for himself and his children, he can save another Rs 3,000 in tax. Opting for debt funds instead of FDs will save him Rs 15,450 in tax.