As North Block has begun work on the

Finance Bill 2017, ET Wealth reached out to experts from the financial services industry to know what they want to see in the coming Budget. Here are suggestions from some experts for Finance Minister Arun Jaitley and his team on how the coming budget can help reduce the direct

tax burden on the common man and also make

tax compliance easier.

Abhishake Mathur, Head, Investment Advisory, ICICI Securities

Increase overall tax deduction limit to Rs 3.5 lakh

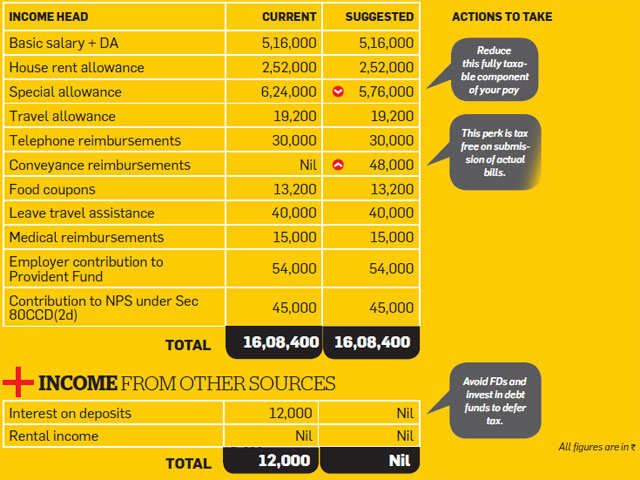

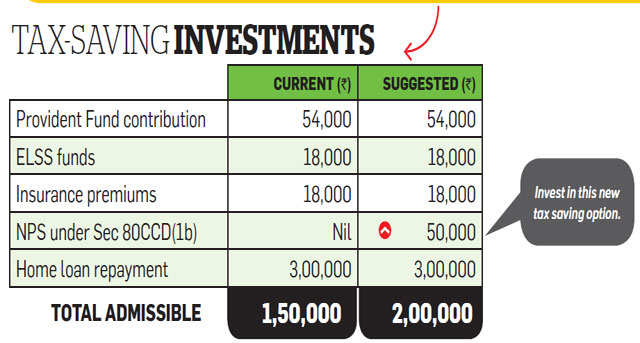

Demonetisation could drive more investments from real assets to financial assets. Currently, household savings are heavy on physical assets, with investments in shares and debentures accounting for less than 1% of GDP in the last financial year. The Budget should help channelise savings and investments into financial assets, specifically the capital markets. One expectation is an increase in the investment limits to Rs 3.5 lakh under Section 80C, 80CCC and 80CCD(1B), which is currently at Rs 2 lakh. The tax deduction limit should be made fungible and applicable to all products held in a tax shield account, to allow flexible asset allocation.

Vaibhav Sankla, Director, H&R Block India

NRIs trying to sell property located in India are subjected to harsh TDS provisions. The buyer often ends up deducting more than necessary, due to lack of clarity. The Budget should prescribe basic rules for the buyer to consider the seller’s acquisition date and cost, and provide reinvestment-based exemption.

Sudhir Kaushik, CFO and Co-founder, Taxspanner.com

Exempt senior citizens from TDS or raise the threshold

If interest income exceeds Rs 10,000 a year, banks deduct 10% tax at source. To avoid TDS, one can submit a Form 15G and 15H, but this poses difficulties for senior and super senior citizens. First, submitting the Form 15G requires a visit to the bank, and if tax has already been deducted, they have to await the refund. The Budget should either exempt senior citizens from TDS, or raise the threshold from Rs 10,000 to at least Rs 50,000 for them. Online submission of Form 15G and 15H should also be allowed, so that senior citizens don’t have to visit the bank branch. Further, in a scenario of declining interest, it is important to provide relief to senior citizens as they cannot afford to choose risky options to maximise their return. Also, under Section 80TTA, all taxpayers enjoy tax exemption for up to Rs 10,000 interest earned on the balance in the saving bank account. This exemption limit should be enhanced to Rs 1 lakh for super senior citizens (above 80) since they don’t want to lock up money in investments at this stage of life.

Also Read: 25 Budget ideas

Anil Kothuri, President & Head of Retail Finance, Edelweiss Financial Services

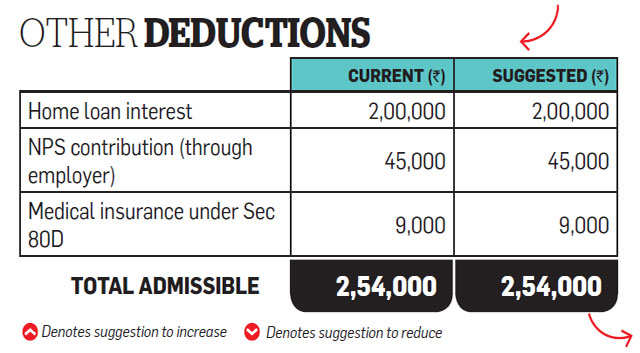

Increase home loan interest deduction to Rs 5 lakh

More than 16 years ago, the Atal Bihari Vajpayee government announced tax deduction of up to Rs 1.5 lakh on interest paid for a home loan, boosting the middle class dream of owning a house. This limit remained unchanged for 15 years and was enhanced to Rs 2 lakh only two years ago. Over the same period, property prices trebled, but the deduction limit for interest paid increased only marginally. There is a strong case for raising the limit to Rs 5 lakh so that it keeps pace with inflation and rising property prices. This will ensure that those who have taken home loans of up to Rs 50 lakh pay an effective interest rate of 6%. Consequently, this will make home ownership affordable for the middle class, further enabling the ‘Housing for All’ agenda of the government.

Komal Agarwal, Chartered accountant

Higher basic tax exemption limit for female taxpayers

A report by Monster India says that the gender pay gap in India is as high as 27%. While men earned a median salary of Rs 288.68 per hour, women earned 27% less at Rs 207.85 per hour. The Finance Minister can set this right in the forthcoming Budget by introducing a higher basic exemption for female taxpayers. Till 2011-12, female taxpayers used to enjoy a higher basic exemption but the 2012 Budget removed this difference. If the basic deduction for females is Rs 20,000 higher, their tax outgo will be lower by Rs 2,060.

Kuldip Kumar, Partner and Leader Global Mobility Practice, PwC India

Extend the LTA benefit to international journeys

At present, tax relief for leave travel assistance (LTA) is restricted to two journeys performed in a block of four calendar years. Also, the relief is restricted to economy class airfare or first class rail fare, for traveling with family within India. Considering that there is now increased awareness about international travel and availability of cheap holiday packages, Indian families do travel abroad for their annual holidays. It would be good to extend the LTA benefit to international journeys and in addition to the airfare, other expenses such as boarding and lodging too should be eligible for exemption. Further, the tax benefit should be available on financial year basis rather than restricting it to two journeys in a block of four years.

Nitin Baijal, Director, Deloitte Haskins & Sells LLP

Clarify the rules of claiming foreign tax credit

Considering the large globally mobile workforce, the Budget should clarify rules relating to the foreign tax credit. Employers claiming foreign tax credit at the withholding stage is one area that needs consideration. Domestic tax laws are silent on this. In the absence of clear rules, the employer generally does not provide relief to the employee at the withholding stage, leaving the employee with no choice but to claim this benefit at the time of filing tax returns. Since credit is claimed only at the time of filing returns, it results in large refund situations thus impacting the overall fund flow of the individual.

Diwya Baweja, Partner, Deloitte Haskins & Sells LLP

Reintroduce standard deduction for salaried taxpayers

For a salaried taxpayer, tax laws do not allow deduction of any expenses incurred during the course of employment other than professional tax. Even this is not available in many states. Standard deduction should be reintroduced to give some relief to salaried taxpayers. It was scrapped nearly a decade ago when the basic exemption limit was raised to Rs 1 lakh. At that time, standard deduction was the lower of 40% of salary or Rs 30,000 for employees earning up to Rs 5 lakh a year and Rs 20,000 for others. The limit should be increased since this was almost a decade ago.

While broadening of tax slabs benefits all individuals, the introduction of standard deduction benefits only salaried taxpayers. It will increase the disposable income and bring some parity amongst salaried taxpayers and individuals running a business or profession.

Sonu Iyer, Tax Partner, EY India

“The government should fully exempt tax on interest from fixed deposits for senior citizens. There should be reintroduction of standard deduction and replacement of all current tax exemptions like HRA and expense reimbursements like medical expenses, LTA etc.”

Anand Bagri, Head-Domestic Markets, RBL Bank

Make interest on bank FDs tax-free up to Rs 1.5 lakh a year

Most researchers and economists say the bulk of black money sits in the form of cash, real estate and gold (real assets). The government needs to focus more on ways to attack real asset holdings and incentivise investments in financial assets. Also, the average Indian investor’s allocation towards financial assets (fixed income or equity) is very low, and the finance minister should incentivise investments in financial assets too. Make interest on bank fixed deposits (FDs) for individuals tax free up to Rs 1.5 lakh per annum. This also helps senior citizens and savers who do not want to take equity risks on their portfolio. The government should also make interest on government securities tax free for individuals. This provision was earlier there under Section 80L but was repealed. The government should reintroduce it as it would help retail participation in government securities and also help individuals lock in to interest rates for longer maturities of 10-20 years.