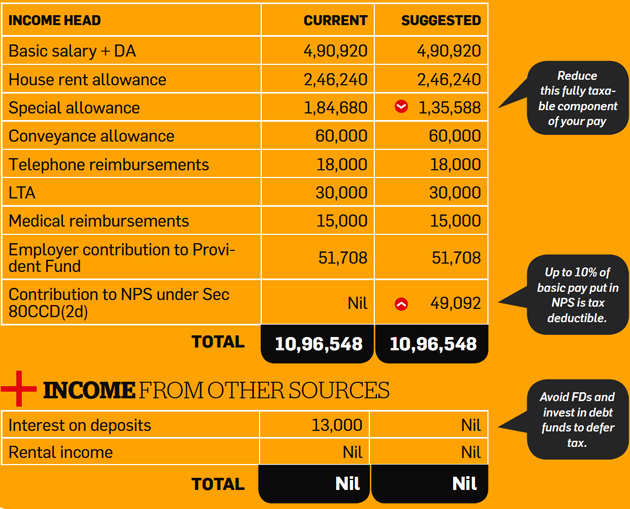

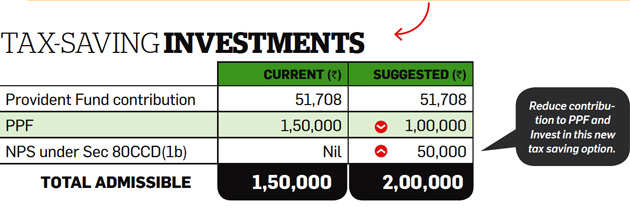

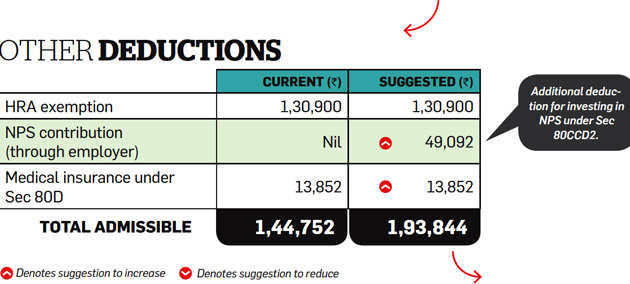

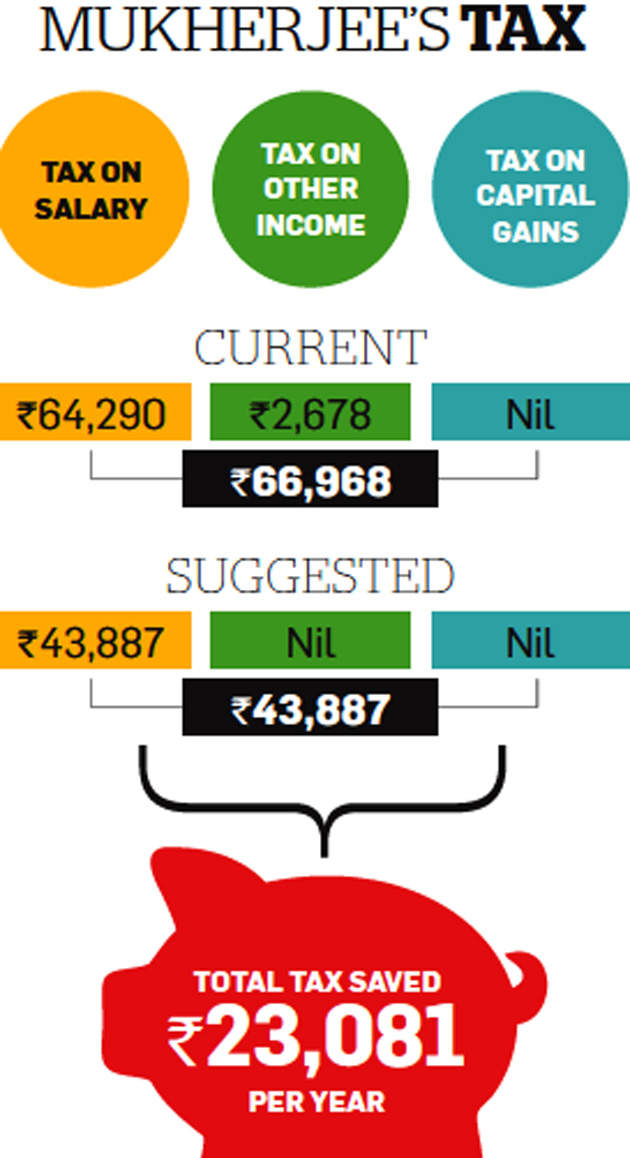

But his take home pay will also come down. Mukherjee should start by asking his company to put 10% of his basic pay in the NPS under Section 80CCD(2d). If Rs 49,092 is put in the NPS every year, his tax will reduce by nearly Rs 10,000. But this will reduce his take-home pay by almost Rs 3,250 per month. The NPS can reduce his tax further if Mukherjee puts Rs 50,000 in the scheme under Section 80CCD(1b). This will cut his tax by another Rs 10,300. Mukherjee should reduce the contribution to the PPF by Rs 50,000. The PPF offers only 8% returns and could see a further rate cut in December this year.

On the other hand, the NPS has given terrific returns due to the bond rally. Given his age, Mukherjee should allocate 33% in all three fund categories. He can also opt for the moderate lifecycle fund of the NPS, in which the exposure to equity comes down by 2% every year.

Income from employer

(All figures are in Rs)

(By Sudhir Kaushik of Taxspanner.com)