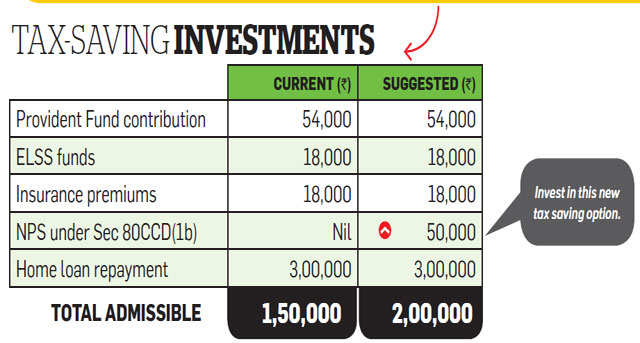

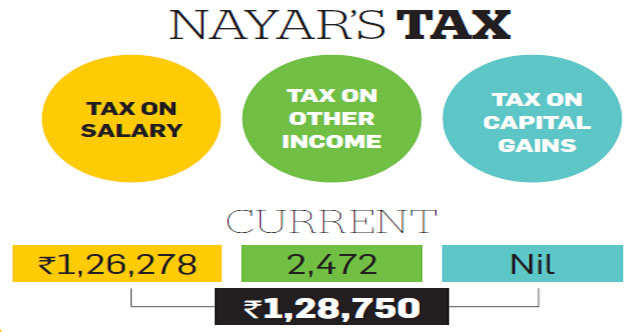

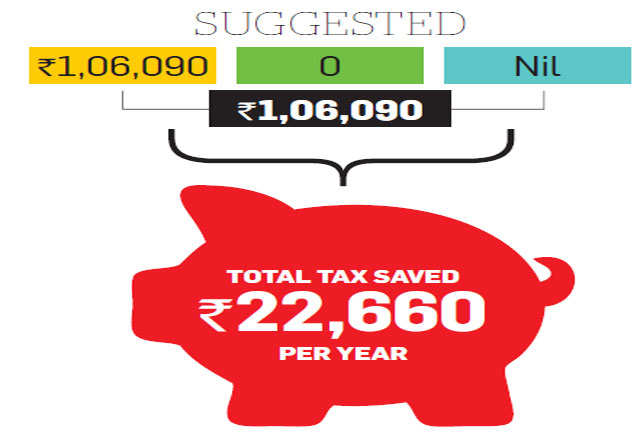

Nayar should start by asking for reimbursements of expenses on conveyance. If he gets Rs 48,000 for conveyance, his tax will be down by almost Rs 9,900. Next, he should invest Rs 50,000 in the NPS under Sec 80CCD(1b). This will cut his tax further by Rs 10,300. Nayar is young so he should choose the auto-choice option that allows up to 75% exposure to equity funds. Keep in mind, however, that NPS locks up the money till retirement.

Another way to save tax is by switching from fixed deposits to debt funds. The interest from fixed deposits is fully taxable, while the gains from debt funds are taxed at a lower rate if the holding period exceeds three years. Moreover, unlike fixed deposits the tax is not payable every year but only at the time of withdrawal. Nayar can save almost Rs 2,500 this way.

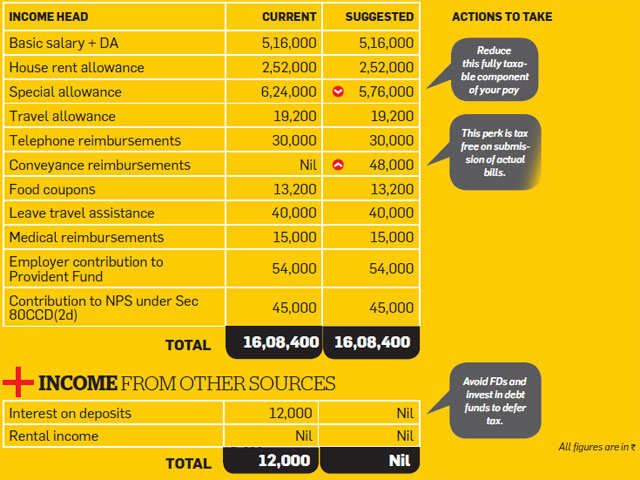

INCOME FROM EMPLOYER