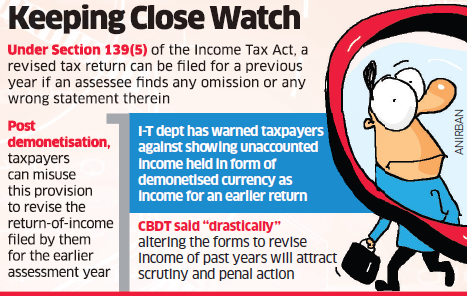

The Central Board of Direct Taxes (CBDT) has said those “drastically” altering the forms to revise income of past years will face scrutiny and penal action. Under Section 139(5) of Income Tax Act, a revised tax return can be filed for a previous year if an assessee discovers any omission or any wrong statement therein.

“The provision to file a revised return... has been stipulated for revising any omission or wrong statement made in the original return of income and not for resorting to make changes in the income initially declared so as to drastically alter the form, substance and quantum of the earlier disclosed income,” the CBDT said in a statement. It said post demonetisation, some taxpayers may misuse this provision to revise the return-ofincome filed by them for the earlier assessment year to show unaccounted income held in the form of demonetised currency as income for an earlier return.

“Any instance coming to the notice of the I-T department, which reflects manipulation in the amount of income, cash-in-hand, profits etc and fudging of accounts may necessitate scrutiny of such cases so as to ascertain the correct income of the year and may also attract penalty and prosecution in appropriate cases as per provision of law,” it said.

Amarpal Chadha, tax partner at EY, said, “It is a welcome move by the CBDT so that people do not take advantage of the revision provisions under tax law and revise the return of income filed for earlier assessment years for manipulating the income, cash etc.”