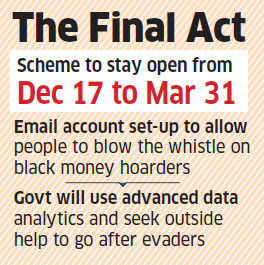

Pradhan Mantri Garib Kalyan Yojana (PMGKY), 2016, will start on December 17 and remain open until March 31 next year. Those who declare cash deposits under this will be levied a charge of 50%, which breaks down into 30% tax, 33% surcharge and 10% penalty. In addition to this, 25% of the amount declared will go into the noninterest-bearing Pradhan Mantri Garib Kalyan Deposit Scheme, 2016, for four years.

PM Narendra Modi announced that Rs 500 and Rs 1,000 notes would cease to be legal tender on November 8. Later, the government said it would unveil one more window for black money holders after the Income Disclosure Scheme closed on September 30.

Declarations under PMGKY will be confidential and those taking advantage of it will escape prosecution. “The government has given a long window for the declarations because we want people to voluntarily come forward and make their declarations,” said Revenue Secretary Hasmukh Adhia while notifying the new scheme.

“We do not want inspector raj.” Part of PMGKY’s proceeds will be used for the benefit of the poor. Those who don’t take advantage of the scheme and are caught later will face up to 85% penalty, besides prosecution. Not declaring undisclosed cash or deposits in banks under the scheme now but showing it as income in the tax return form would attract a total of 77.25% in taxes and penalty.

The scheme was notified after the Taxation Laws Second (Amendment) Bill, 2016, came into force on December 15. The Bill was passed by the Lok Sabha but could not be taken up in the Rajya Sabha due to Opposition protests.

Adhia said most banks will have PMGKY scheme forms starting Saturday.“Only after payment of 50% tax and setting aside 25% of the remaining undisclosed amount for four years can a person avail the PMGKY scheme,” he said. In the recent Income Disclosure Scheme and other such plans, disclosures were made first and taxes recovered later.

The revenue secretary warned that the mere deposit of demonetised cash will not make it white, adding that the government was getting data from multiple sources and action will be taken accordingly.

The government has also set up an email address — blackmoneyinfo@ incometax.gov.in — where people can send information on those having black money and are trying to launder it. The email id will be monitored by a cell that will take immediate action based on tips.

CASH, JEWELLERY SEIZED

Central Board of Direct Taxes (CBDT) Chairman Sushil Chandra said the government had seized cash amounting to more than Rs 316 crore, of which new currency was about Rs 80 crore, and jewellery worth Rs 76 crore. “We conducted 291search and seizures, 295 surveys and issued around 3,000 notices on the basis of deposits post-demonetisation,” he said and added that the concealed income is about Rs 2,600 crore based on credible information. In addition, 3,000 open enquiries have been made seeking details.

Chandra said CBDT is collecting information on all bank accounts and correlating this with existing income-tax data.

“So the assessees should know that their deposits in bank accounts are being watched. We are examining whether it is explained money or not. Therefore, they should come very, very clean under this scheme which is the last window available for anyone,” he said.

Adhia said banks will gather the permanent account numbers (PAN) of all accountholders except for Jan Dhan accounts within a month’s time. He said in 12 cases of “unscrupulous conversion” of old notes into new currency, the Central Bureau of Investigation (CBI) has filed first information reports while the Enforcement Directorate has filed 17 cases of money laundering. Common methods of laundering such as purchase of bullion, jewellery, backdating of cash transactions, depositing cash in multiple accounts just below Rs 2.5 lakh, depositing cash in Jan Dhan, dormant and shell company accounts and use of cash for repayment of loans were all under watch, he said.