Professionals had to maintain record of all work-related expenses incurred for up to eight years after filing the returns. Moreover, those with an annual income of Rs 10 lakh or more were required to get their expenses duly audited.

This scheme will also make their tax filing easier. They would now be able to opt for the simpler ITR 4S over the lengthy and tedious ITR 4."The scheme is bound to find immense popularity with consultants and freelancers who find it difficult to keep track of expenses and receipts," says Archit Gupta, CEO, cleartax.in. However, TDS at 10% will continue to apply to freelancers as applicable under Section 194J of I-T Act. "This should not be a deterrent as they may seek a refund later if they have lower taxes to pay overall," says Gupta.

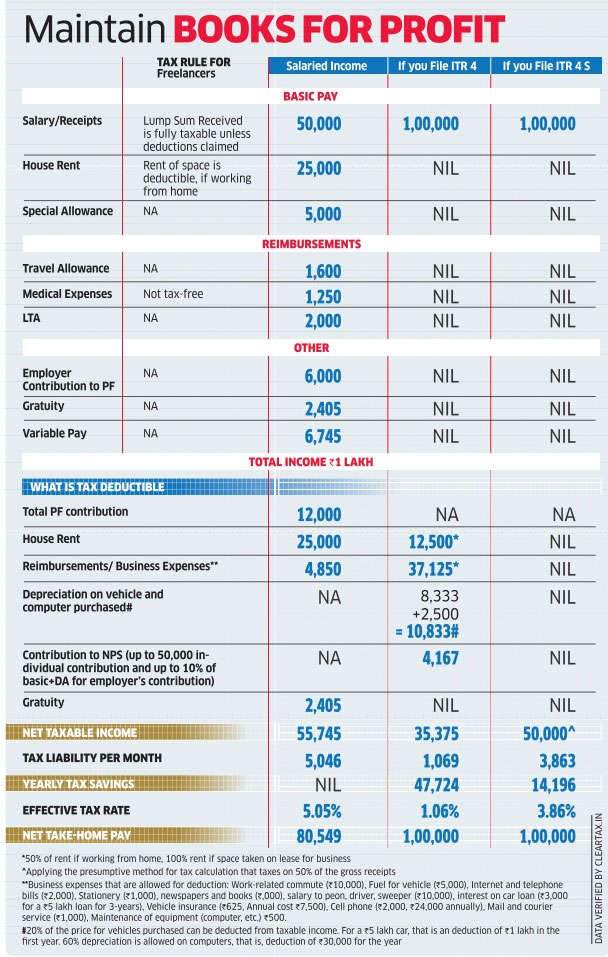

However, these conveniences can result in a tax loss. Although the presumptive tax method might be an easier process, you will still save more by maintaining books of accounts (see table).

The real benefit of being a consultant or a freelancer kicks in with deductible expenses. So, if your deductibles are more than 50% of your income or are running at a loss resulting in a negative income, you should have your profit and loss statements in place.

It is not very expensive to get professional help if you want to avoid taking the hassle yourself.

The popular online tax filing platforms have basic plans for freelancers starting at as low as Rs 3,500 and going up to Rs 10,000 to Rs 12,000 where you need not do anything.

Offline, a chartered accountant consultation will cost you almost the same. What's more, you can deduct this expense from your business income.

The presumptive tax scheme is a real boon only for people who might not have too many business expenses. Say a private tutor or a human resource consultant, who has business income but not too many expenses as deductions to show, by opting for the new section 44ADA, your taxable income becomes half immediately. You need not provide any proof of any receipts or expenses and yet get a 50% deduction on your taxable income. Experts feel that they might even misuse the scheme.

Another thing to consider before you go for presumptive tax scheme is the five-year clause. If the you opt for Section 44ADA, you have to remain in it for the next five years. If you fail to do so in any of the five years, you will not be eligible to claim the benefit under the scheme for the next five years.