The rage over the new tax on withdrawal from employees' provident fund (EPF) is because the government is seen to be attempting to steal the hard-earned savings of salaried private sector employees. Unlike government employees, private sector workers do not have guaranteed pension or healthcare plan to take care of their sunset years.

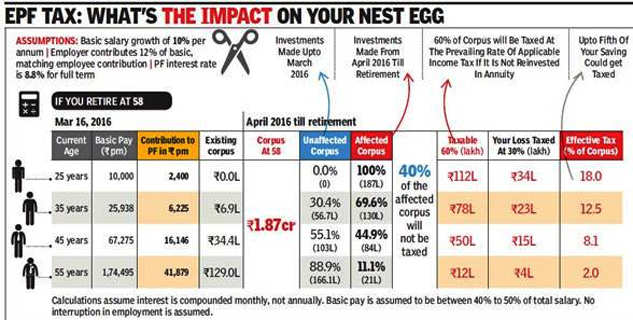

Ever since news of the EPF tax broke, people have been worrying about how much of an impact it will have on their nest egg. TOI did the calculations and as the table above shows, if the government goes ahead with the tax on the interest accrued on PF contributions after April 2016, a person starting his career after this could lose 18% of his entire retirement savings at provident fund maturity. Even those in the middle of their career face the prospects of losing between Rs 10 lakh and Rs 20 lakh (12% to 8%) of their retirement corpus.

All this to nudge people towards the National Pension System (NPS) which has failed to get the number of subscribers it expected to because the scheme does not generate as high post-tax returns as the EPF does. By taxing 60% of the interest on EPF withdrawal—if it is not invested in annuity — the government is attempting to make it less attractive for people so that more investment flows into the NPS.

A better way to mend the EPF could have been to fix the dysfunctional employees' pension scheme (EPS), which is a part of EPF. Every EPF member mandatorily contributes towards EPS, but the scheme is designed so badly that the monthly pension cannot exceed Rs 4,000 — an amount that won't equal even 1% of the lastdrawn total monthly salary in many cases.

Times View

The proposal to tax part of the corpus of provident funds on withdrawal needs to be rolled back completely. The salaried middle class has consistently borne the brunt of direct taxation in India and it is unfortunate that instead of making a serious and concerted effort to widen the net, successive governments have opted to squeeze honest taxpayers at every available opportunity.

The latest proposal amounts to double taxation, since the employee's PF contribution is in any case not tax exempt beyond the 80C ceiling of Rs 1.5 lakh per annum.

Thus, those with just decent salaries — often in the last few years of their working lives — would end up having their contribution taxed in the fi rst instance and then 60% of it taxed again at the stage of withdrawal. As for those starting their careers now, quick calculations show they could stand to lose nearly a fi fth of their retirement savings to tax. This is grossly unfair.

The government's argument that the move is aimed at encouraging people to plan for pension for their old age ignores the fact that EPF already has a pension component — in the form of the employees' pension scheme — whose fl awed design has resulted in low payout. Instead of forcing people to move to the national pension system, it should revamp the EPS.

This would ensure competition between EPS and NPS and investors would have the option to choose. If the idea is to promote competition and free market across the economy, why go back to the regulated regime of old? The government shouldn't let ego stand in the way of acknowledging the inherent unfairness of what it's seeking to do.

In any democracy, Budget proposals are not cast in stone and should become law only after debate and discussion. The government should pay heed to the spontaneous sense of outrage this proposal has evoked and let it go. It'll only gain goodwill by doing so.