"In view of the representation received, the government would like to do a comprehensive review of this proposal and therefore I withdraw this proposal," finance minister Arun Jaitley said in a statement in the Lok Sabha.

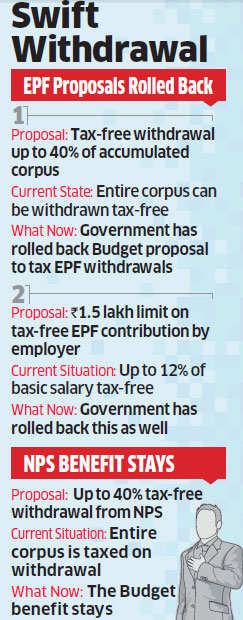

The 40% rebate proposed for the NPS will however continue. NPS is at present fully taxed on withdrawal. This is a relief for NPS subscribers.

The proposal had come under fired from all quarters and government ministers have been flooded on social media to withdraw the proposed tax.

A day after the budget government had even issued a statement clarifying the intent behind the proposal and its intent and its limited impact, but the criticism continued prompting the government to withdraw the tax.

There is at present no tax on withdrawal from employee provident funds and other superannuation funds. In the recent budget, the government has proposed that withdrawal in excess of 40% of the accumulated corpus will be taxed.

FM said idea behind the proposal was not to raise revenues but to achieve the policy objective of creating a pensioned society.

He many suggestions had been received how this could be achieved without imposing the tax.

The prime minister's office had also been in favour of the withdrawal that had dominated the post budget debate.

The government has also withdrawn the proposal to limit tax-free contribution by the employer to the provident fund of an employee to Rs 1.5 lakh per annum.