Once non-compete agreements were largely restricted to the manufacturing arena.For instance, an outgoing employee would have to sign on the dotted line that he would not share knowhow or a patent that he had helped develop during his employment. Or if he was an inventor, he could be debarred under the non-compete agreement from starting a similar line of business for a certain period. The money received under such non-compete agreements was duly taxed.

"There was no specific provisions to cover professionals who could argue that the sum of money received by him under a non-compete agreement was not taxable," says Gautam Nayak, tax part ner, CNK & Associates.

Now a wide gamut of pro essionals -such as those in he legal, medical, enginee ring or architectural profes sion, or engaged in accoun ancy , consultancy and inte rior decoration, to name a few -have no escape from paying their tax dues when they receive money under a non-compete agreement.

The nature of the tax will be based on the nuances of the agreement. The money received could be taxed either as a capital gain or as income from business or profession. Nayak illustrates: "If a managing partner in a consultancy transfers the right to carry on the firm in its existing name, the sum of money received by him would be a capital gain, subject to a lower rate of tax, assuming the managing partner falls in a higher tax bracket. But if the managing partner decides not to set up a competing consultancy business for a certain period of time, say three years, then the sum of money received under the non-compete agreement will be treated as income from business or profession and taxed at the applicab le income tax rates."

One of the most significant developments in the transfer pricing arena contained in the Finance Bill, 2016 is the introduction of Country-by-Country Reporting (CBCR) norms for the purpose of transfer pricing documentation.

"The new requirement comes into being from April 1, 2016 (financial year 2016-17) for Indian parent companies having consolidated turnover in excess of 750 million euros (or Rs 5,395 crore at current exchange rate). India's transfer pricing authorities will also be able to access CBCR documentation of parent companies, outside India, which have subsidiaries in India, via the mutual exchange of information agreements," explains Sanjay Tolia, partner, PwC.

Typically , the CBCR do cumentation requires reporting various details for each country where business operations are carried out by a company , such as amount of revenues, profit before tax, income paid and accrued, number of employees, assets, and details of activities carried out in each country . CBCR documentation will give Indian tax authorities a global picture of the operations of an Indian-headquartered company and of multinational companies having business in India, and deter mine whether appropriate profits are apportioned to the business operations carried out in India.

|

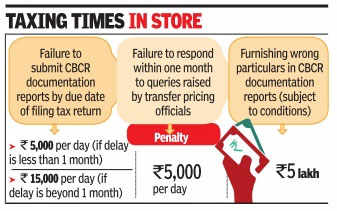

Indian-headquartered companies having interna tional operations will need to file CBCR documentation reports for the FY2016-17, before the due date of filing of the tax return, which is November 30, 2017. A graded stiff penalty structure has been prescribed for various noncompliances (see table).

"While CBCR is expected to bring in increased transparency , it is likely to increase compliance burden significantly. Transfer pricing authorities would want to have updated information at least on a yearly basis," says Hitesh Gajaria, chartered accountant and transfer pricing specialist.

"An Indian company , whose parent is resident of a country which is perceived as not co-operating with India for exchange of information, say Cyprus, will find it tougher. The Indian company may not have all the relevant information pertaining to its foreign parent and non-filing of the CBCR will result in a daily penalty ," adds Gajaria.