Congress spokesperson Randeep Singh Surjewala, in a statement, said: "It is a criminal breach of trust with hapless people who put their money in the custody of the government of India with the belief that they will not be cheated."

In case of PPF, the most popular scheme for middle-class savers, the reduction of 60 basis points (100 basis points equal a percentage point) is among the sharpest in nearly 15 years. Although the rates are to be reviewed every three months, if they remain unchanged during the next financial year, someone with Rs 5 lakh in his PPF account would face a hit of Rs 3,000 in 2016-17.

A reduction in rates on small savings is bad news for those with large balance in fixed deposits, especially senior citizens, as banks are now expected to follow government action with similar cuts.

For long, banks and RBI had urged the government to reduce small savings rates to ensure that banks cut deposit rates. This, in turn, will pave the way for lower lending rates and translate into lower EMIs in the coming months, should the banks decide to pass on the benefit. However, given that a two-three year fixed deposit (FD) with SBI fetches the highest rate of 7.5% a year, savings in PPF still remain more attractive, especially with tax benefits thrown in.

Though pressure had been building for several months, the government opted for a change from April, which is the annual date for reset. "It's normal practice for the last few years to change interest rates from April and we have followed that. The rates are linked to the yield on government securities and we have followed the same practice with a mark up for senior citizens, Sukanya Samridhi Scheme, PPF and NSC," economic affairs secretary Shaktikanta Das told reporters.

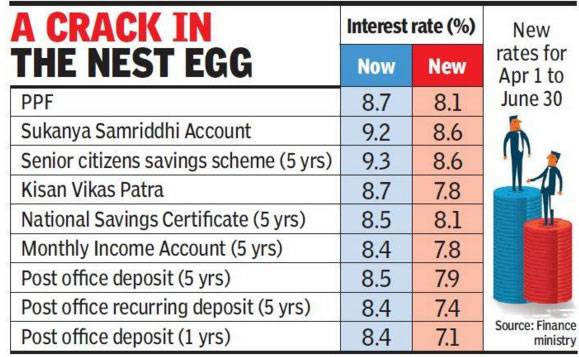

The interest rate for the national savings scheme was also reduced sharply from 8.5 per cent to 8.1 per cent, for Kisan Vikas Patra (KVP) from 8.7 per cent to 7.8 per cent and for five-year recurring deposit to 7.4 per cent from 8.4 per cent.

Even the girl child scheme Sukanya Samridhhi Account (SSA) was not spared. The cut: From 9.2 per cent to 8.6 per cent.

"The new rates will be effective from next fiscal (April 1, 2016). The interest will be calculated on quarterly basis," AK Chauhan, joint director in National Savings Institute (NSI), told IANS.

According to him, the main reason for the downward revision was the two year yield on government securities (G-Sec) had gone down.

The interest rates for various small savings schemes were recalculated with reference to the G-Sec yields of equivalent maturity for the period December 2015-February 2016, and based on it, rates on various schemes for 2016-17's first quarter have been notified.

Communist Party of India-Marxist (CPI-M) general secretary Sitaram Yechury hit out, tweeting: "Small savers are the backbone of our savings. With no social security net, they rely on such guaranteed returns."

Chauhan said the total corpus of all small savings scheme was around Rs.300,000 crore. The net accretion this year was around Rs.65,000 crore till January 31.

Earlier, the government had proposed a tax on 60 per cent of the PPF corpus on maturity if it was not invested in annuities - that is schemes that fetch periodic returns. Also proposed was a limit on monetary contributions of employers in provident fund to Rs.150,000 per annum for tax sops.

Both these were withdrawn. "Government's decision to cut PF interest rates is unfortunate.Why are they taking away one of the last avenues of savings in a depressed economy?" Congress leader Ahmed Patel tweeted.