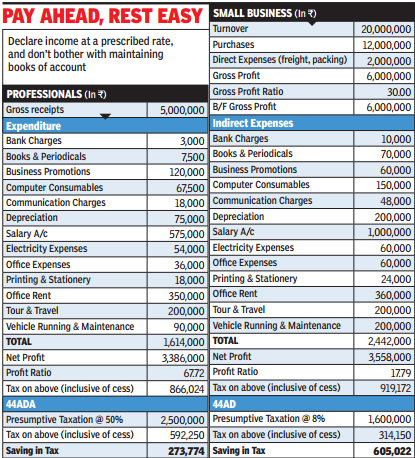

This scheme covers small businesses with gross turnover up to Rs 2 crore — up from the existing ceiling of Rs 1 crore. It has also been extended to professionals with gross income up to Rs 50 lakh. So what exactly is presumptive taxation? As per Section 44AA of the Income-tax Act, 1961, a person engaged in business is required to maintain regular books of account. However, a person adopting the presumptive taxation scheme can declare income at a prescribed rate of 8% and, in turn, is relieved from the tedious job of maintaining books of account.

However, in case income earned is at a rate higher than 8%, then the higher rate can be declared.

And with the inclusion of professionals, a new Section 44ADA is proposed to be inserted in the Act to provide for estimating the income of an assessed who is engaged in any profession referred to in sub-section (1) of Section 44AA such as legal, medical, engineering, architecture, accountancy, technical consultancy, interior decoration or any other profession as is notified by the board in the official gazette and whose total gross receipts does not exceed Rs 50 lakh in the previous year. For the purpose, 50% of the total receipts of the professional during the financial year will be considered as profit and get taxed under the income-tax head "profits and gains of business or profession".

If you look at the table, it's clear that the assessee not only saves on record-keeping headaches, he also saves a considerable amount in taxes. Yes, there can be a few counters to this — mainly that the taxable income could be much below the presumptive taxation rate of 8% and 50% of receipts respectively. And if that is the case then the individual has no option but to maintain the books of accounts.

To further keep the compliance burden minimum, those using presumptive taxation scheme are also allowed to pay advance tax by March 15 of the financial year, as against the normal practice of paying the advance tax in four installments.

However, the taxpayer needs to be careful when opting for this as he or she has to remain in that scheme for 5 years to avail the benefits.

The writer is a certified financial planner