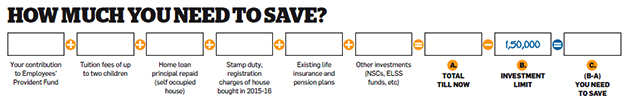

This week's cover story is aimed at taxpayers who still have to invest under Section 80C. As a first step, calculate how much more you need to invest. Many taxpayers don't know that tuition fees of up to two children is eligible for deduction under Section 80C. For many parents with schoolgoing children, this takes care of a large portion of their tax-saving investment limit.

Also, the principal portion of the home loan EMI and the stamp duty and the registration charges paid for a house bought during the year are all eligible for the deduction. If they include the contribution to the Provident Fund and premiums of existing insurance policies, they might discover that their tax planning is nearly taken care of. Use the table provided to calculate how much more you need to invest this year.

|

|

Put small amount in ELSS

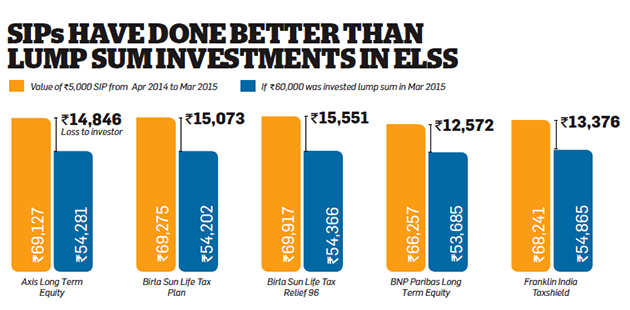

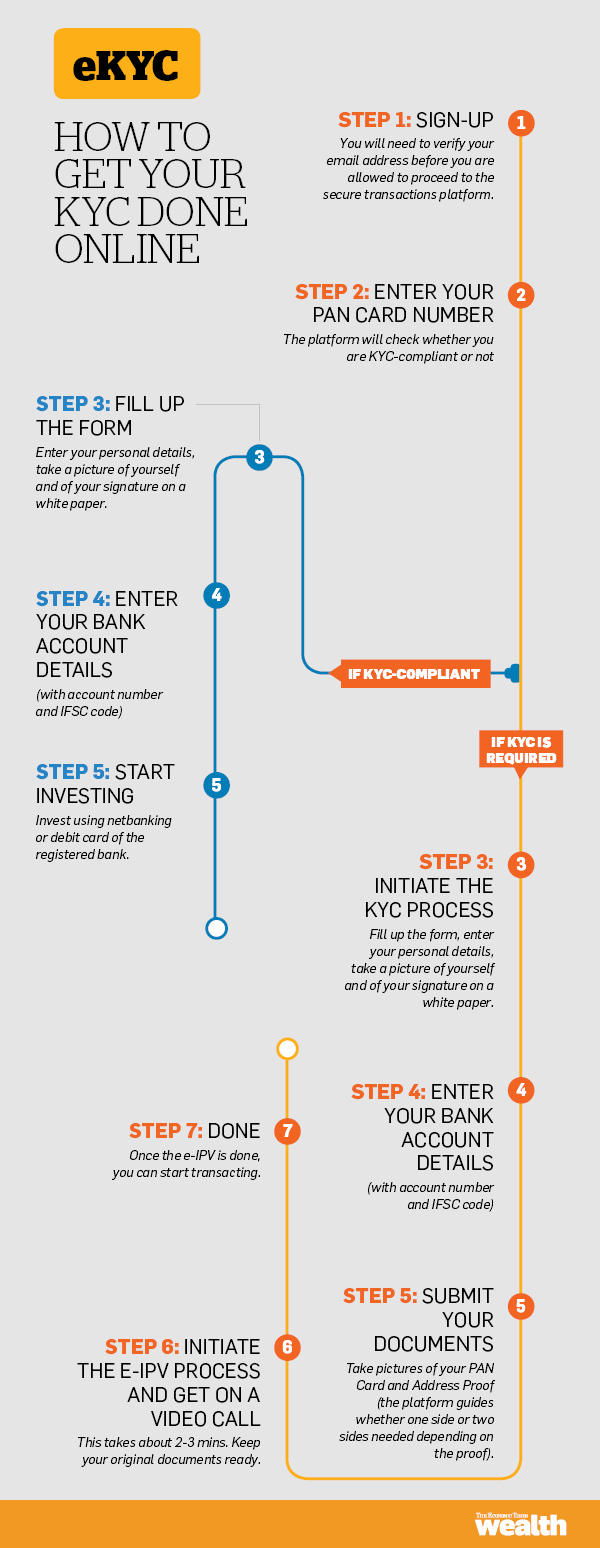

Your approach now should be different from what we advised earlier this year. In January, we had listed ELSS funds as the best tax-saving instrument. They are low on charges, fairly transparent, offer high liquidity, the returns are tax-free and they have the potential to create wealth. Also, you are under no compulsion to make subsequent investments. Investing in ELSS funds is easy because you can apply online. Many fund houses even pick up KYC documents from your residence. You can also get your KYC done online.However, at the same time, studies have shown that a staggered approach works best when investing in equity funds. It's too late to take the SIP route in March and investing a large sum at one go can be risky. Investors who took the SIP route in top ELSS funds in 2014-15, have made money, but those who waited and invested lump sum in March 2015 are saddled with losses.

Go online to catch the NPS bus before March 31

Unfortunately, not many investors understand the simple logic behind SIPs. Barely 15% of the total inflows into the ELSS category comes through monthly SIPs and nearly 25% of the total inflows are invested as lump sum in March. We suggest that you avoid putting a large sum at one go in ELSS funds and put only a small amount at this stage. It's best to start an SIP after April in a scheme with a good track record.

|

PPF and FDs are safe bets

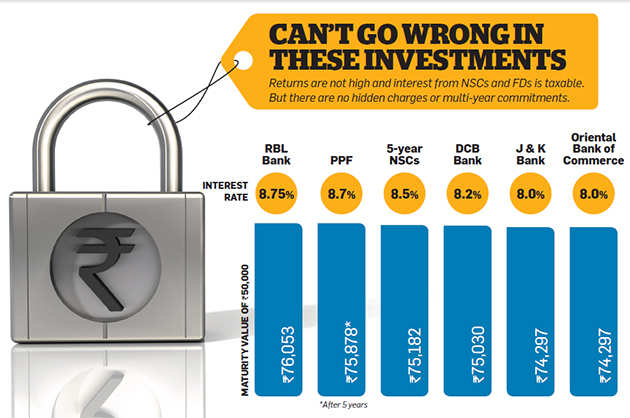

Unlike the ELSS funds, you can invest blindly in the PPF. If you already have a PPF account, just put the remaining portion of your Section 80C limit in it and be done with it. Opening a new account at this stage may not be feasible if you have to submit the proof of investment this week. Even if you manage to open an account, you will be cutting it too fine. If your investment cheque is not encashed by 31 March due to any reason, you may be denied the deduction for this year. Some banks like ICICI Bank allow online investments in the PPF, which is a better option than the offline route.If you don't have a PPF account, go for tax-saving fixed deposits or NSCs. They did not score very high rank in our ranking of tax saving instruments in January because the interest is fully taxable, which brings down the effective post-tax returns in the 30% tax bracket to less than 6%. However, with just two weeks left to go, they could be good options to save tax in a hurry. Sure, you will earn low returns, but there are no hidden charges or any compulsion to invest in subsequent years.

|

Avoid multi-year commitments

March is open season for salespersons masquerading as financial advisers. They will push you to buy insurance policies that can become millstones around your neck. Don't sign up for insurance policies in a hurry. To make things easier for the buyer, the agent even does the paperwork. All the buyer has to do is sign the application form and write a cheque. But any investment that requires a multi-year commitment must be assessed in detail, so don't let the agent force you into a decision.In our January ranking, life insurance policies were at the bottom of the heap. Experts say it is not a good idea to mix insurance with investment. Buy a term plan for insuring yourself and invest in other more lucrative options than a traditional insurance policy that offers 6-7% returns. A costly insurance policy prevents you from investing for other goals. If you are paying a very high premium, it is advisable to turn the policy into a paid up plan. The insurance cover will continue but you can stop paying the premium.

Pension plans from insurance companies also rank very low. Even though 33% of the corpus was tax free on maturity, the low-cost New Pension System (NPS) was seen as a better alternative. Last year, the government announced an additional deduction of Rs 50,000 for investments in the NPS. This year's Budget has made the scheme more attractive by making 40% of the corpus tax free on maturity.

Till a few months ago, opening an NPS account was considered an uphill task. You had to run around for weeks, even months, before the account became operative. This has now changed. Turn to Page 6 to know how you can take the online route to open an NPS account in just 25-30 minutes.

No proof? No problem

Salaried taxpayers are expected to submit proof of investment to their employers by mid-March. That window is nearly closed now. If you have not submitted the proof of your tax saving investments, TDS will be deducted from your March salary. But don't let that stop you from investing now. If you are able to invest by 31 March, you can claim a refund of the excess tax deducted from your salary. However, you will get that money back only when you file your tax return in July.